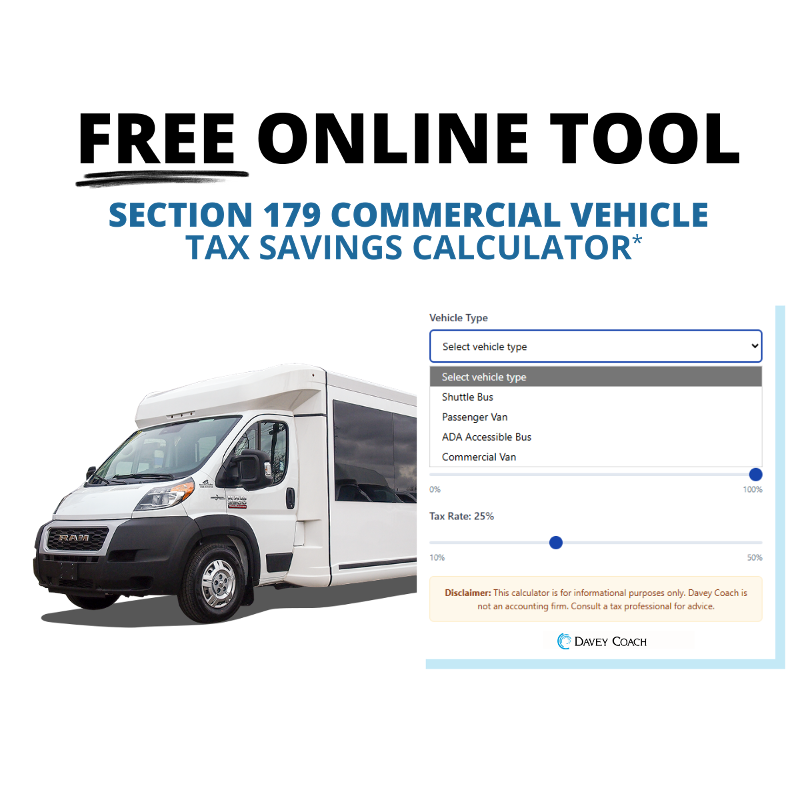

Leverage Section 179 Vehicle Tax Savings

✓

Deduct up to $1.22M

✓ Upgrade your fleet sooner

✓ Keep more cash

Calculate Savings

What Is Section 179?

Section 179 is a provision in the IRS tax code that allows businesses to deduct the full purchase price of qualifying equipment (like shuttle buses) in the year it’s put into service—rather than spreading the deduction out over decades.

For 2025, businesses can deduct up to $1,220,000 on qualifying purchases, with a spending cap of $3,050,000.